fsa health care limit 2022

This is an increase of 100 over 2021. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021.

Insurance Insights January 2022

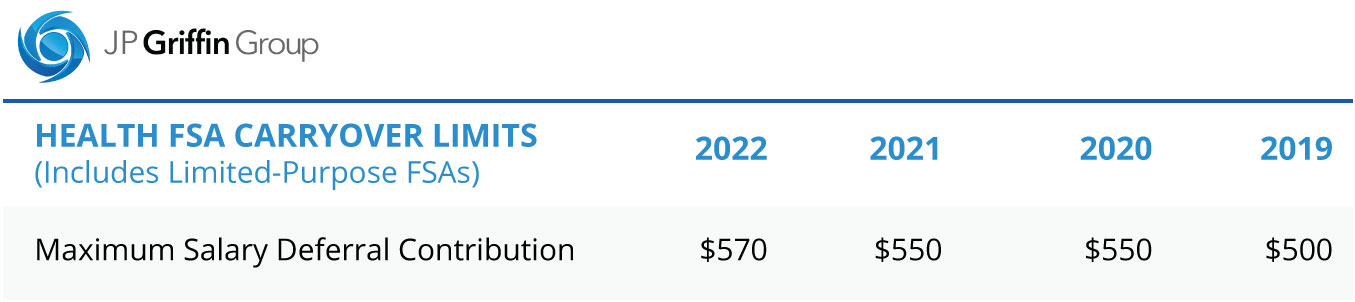

For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year.

. The limit on annual employee contributions toward health FSAs for 2022 is 2850 up from 2750. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. Dependent Care FSAs which previously allowed no carryover also have an unlimited carryover provision in 2021-2022.

And if an employers plan allows for carrying over unused health care FSA funds the maximum carryover amount has also risen up 20 from 550 in 2021 to 570 in 2022. IRS Releases 2022 Limits For Flexible Spending Accounts FSA Health Savings Accounts HSA and Commuter Benefits. Healthcare Flexible Spending Account FSA 2850.

On 111021 the IRS released Revenue Procedure 2021-45 revising the Health Care FSA and Limited Purpose FSA maximum for 2022. The Health Care standard or limited FSA rollover maximum limit will increase from 550 to 570 for plan years beginning on or after January 1 2022. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

The Health Care FSA pre-tax salary reduction limit is per employee per employer per plan year. The amount of money employees could carry over to the next calendar year was limited to 550. The monthly maximum for a Section 132 Pre-tax Parking Plan also increased from 270.

No limits to carrying over funds. Effective January 1 2022 the following will be the new limits. As a result the IRS has revised contribution limits for 2022.

The IRS announced that the health FSA dollar limit will increase to 2850 for 2022. For the 2021 income year it is 2750 26 USC. In addition as part of COVID-19 relief the.

Employers may continue to impose their own dollar limit on employee salary reduction contributions to health FSAs up to the ACAs maximum. The health FSA contribution limit is 2850 for 2022 up from 2750 in the prior year. American rescue plan act of 2022 dependent care fsa.

These new limits also apply to limited-purpose FSAs. If you provide health care FSA employer contributions this amount is in addition to the amount that employees can elect. Monthly Maximum Parking.

125i IRS Revenue Procedure 2020-45. The annual contribution limit for your health care flexible spending accounts health fsas is on the rise for 2022 according to the society for human resource management. This means youll save an amount equal to the taxes you would have paid on the money you set aside.

Among other things the notice indicates that employee contribution limits toward health flexible spending arrangements also known as flexible spending accounts or FSAs and qualified transportation fringe benefits will increase slightly for 2022. Healthcare FSA Carryover. 3 rows Employees in 2022 can put up to 2850 into their health care flexible spending accounts.

The usual carry-over limit is 550 You can also contribute up to. For taxable years beginning in 2022 the health FSA dollar limit on employee salary reduction contributions has increased to 2850. If the employer contributes to the Health Care FSA the employers contribution is in addition to the amount that the.

The Dependent Care FSA annual maximum plan contribution limit is 2500 for those married and filing separately and 5000 for those single or married filing jointly. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. For the 2022 benefit period participants may contribute up to a maximum of 2850 an increase of.

The limit is expected to go back to 5000. The Health Care standard or limited FSA rollover maximum limit will increase from 550 to 570 for plan years beginning on or after January 1 2022. If you have a dependent care FSA pay special attention to the limit change.

For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022. Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC. Compensation amount for determining Highly Compensated Employee.

A flexible spending account FSA is an employer-sponsored benefit that helps you save money on many qualified healthcare expenses. The new maximum will be 2850For plans that permit the carryover of unused amounts the maximum carryover amount has increased to 570. Expanded FSA Grace Period.

Get Help Finding a Plan That Fits. FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can. Ad View Golden Rule Ins Co Short Term Plans To Help Bridge Gaps In Health Coverage.

You can contribute pretax dollars to fund the account. For 2022 the maximum amount that can be contributed to a dependent care account is 5000. Monthly Maximum Mass Transit.

However the Act allows unlimited funds to be carried over from plan year 2021 to 2022. Employers should communicate their 2022 limit to their employees as part of the open enrollment process. 10 as the annual contribution limit rises to 2850 up from.

Employees can elect up to the IRS limit and still receive the employer contribution in addition. So if you had 1000 in your account at the end of this year you could carry it all over into 2022. Medical mileage rate to obtain medical care reimbursable by a Health FSA.

The health FSA contribution limit is established annually and adjusted for inflation. If you have adopted a 570 rollover for the health care FSA in 2022 any. Depending on your employer plan you may lose unused money in your.

The IRS is planning ahead on HSA plans releasing 2022 HSA maximums and limits on 51121. Health Care FSA Limits Increase for 2022. The annual contribution limit for your health care flexible spending accounts health FSAs is on the rise for 2022 according to the Society for Human Resource Management.

At the end of 2022 the carryover will return to 570 which was previously 550. Employees can deposit an incremental 100 into their health care FSAs in 2022. See below for the 2022 numbers along with comparisons to 2021.

125i IRS Revenue Procedure 2020-45. The pre-tax salary reduction limit for Health Care FSAs will increase to 2850 for plan years on or after January 1 2022. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

On November 10 2021 the Internal Revenue Service IRS released Revenue Procedure 2021-45 which increases the health flexible spending account FSA salary reduction contribution limit from 2021 to 2850 for plan years beginning in 2022 an increase of 100 from 2021. Need Health Care Coverage Now. You dont pay taxes on this money.

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

The 2022 Fsa Contribution Limits Are Here

How To Build Windbelt Wind Generator For 5 Using Vhs Tape Wind Generator Diy Wind Turbine Wind Turbine

Organic Mineral Sunscreen Lotion Spf 30 In 2022 Mineral Sunscreen Sunscreen Lotion Spf 30

N 41 Mister In 2022 Prevent Skin Aging Skin Routine Daily Aging Skin

Pin On Top 10 Best Trojan Condoms In 2019

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Fsa Limit Lawley Insurance

An Fsa Grace Period What It Is And What It Can Do For You Wex Inc

Hsa Dcap Changes For 2022 Blog Medcom Benefits

What Is A Dependent Care Fsa Wex Inc

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

N 41 Mister In 2022 Prevent Skin Aging Skin Routine Daily Aging Skin